carbon tax benefits and disadvantages

Up to 24 cash back List of Disadvantages of Carbon Tax 1. Those deserving consumers are selected using a minimum.

27 Main Pros Cons Of Carbon Taxes E C

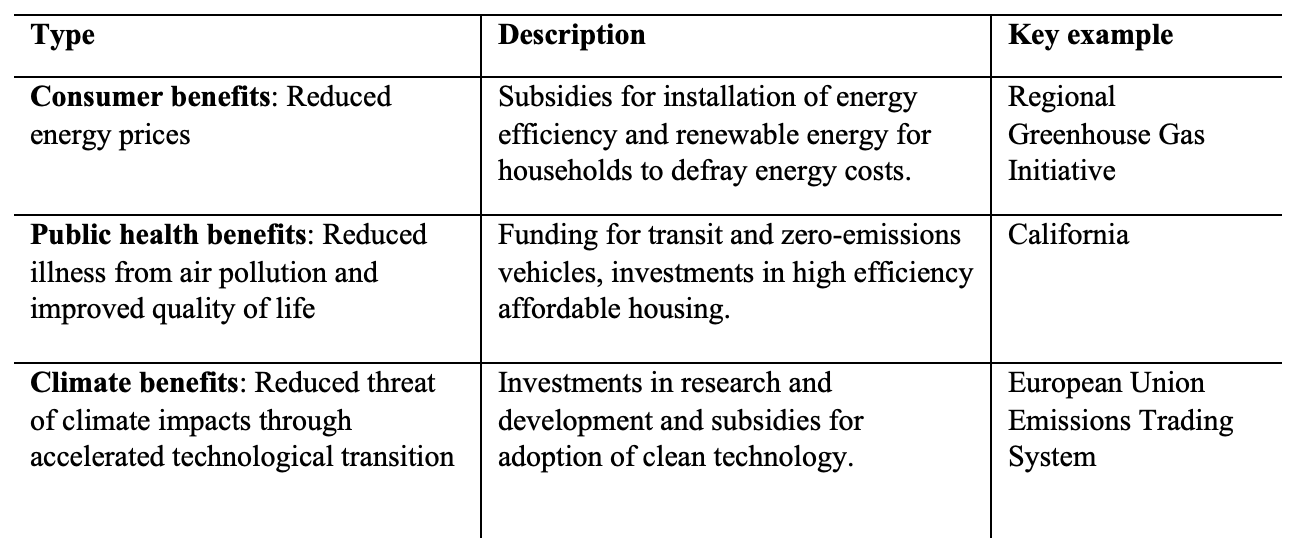

By discouraging fossil fuel use a carbon tax can improve air and water quality and even reduce.

. Theres also harmful particulate pollution and water pollution from strip mines. A carbon tax could force businesses and citizens to cut back carbon-intensive services and goods. While a carbon tax does not offer.

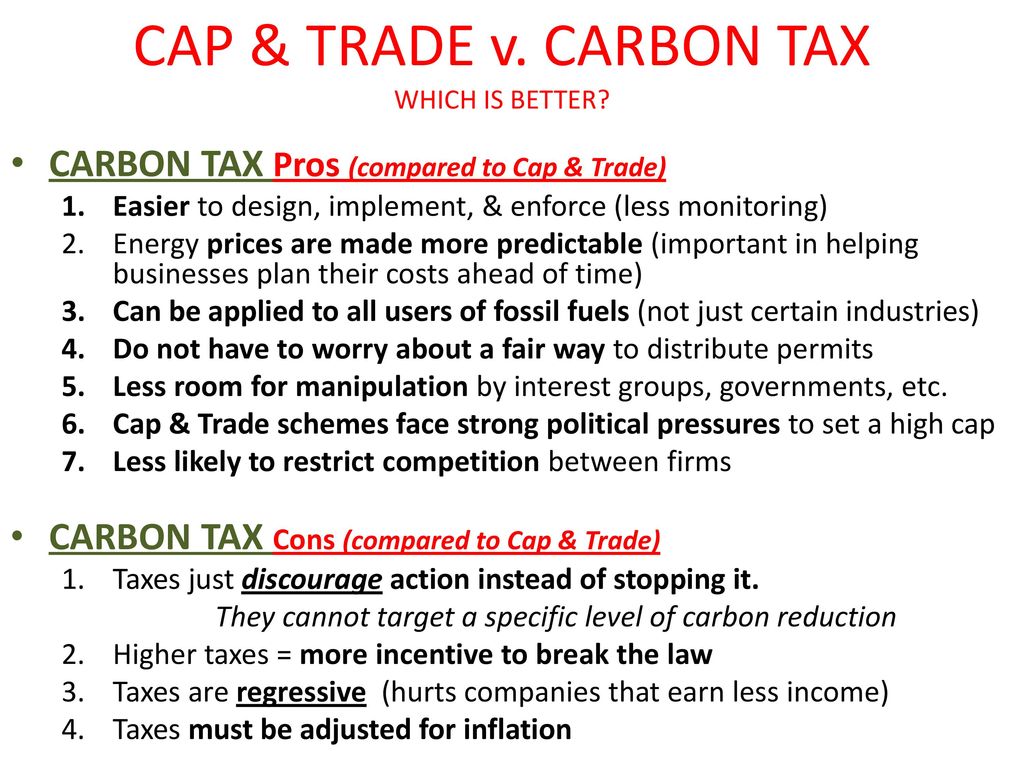

Critics focus on certain disadvantages of carbon taxes or cap-and-trade but their arguments are unpersuasive if policies are well-designed. Higher potential quality of bike frame and other large objectscomponents. It could start a race for lower emissions technologies which.

Alternatively you might be providing funds for greenhouse gas reductions that will happen in the future. The government then returns some of the funds collected from the Carbon Tax to the most deserving consumers. If the system is not designed to meet the demands of the economy it may.

A carbon tax on fossil fuels is often regressive in its impact - hurting poorer people relatively more than richer ones Image. Carbon tax systems could harm the economy if they are not designed properly. Indeed within twenty years a modest carbon tax can reduce annual emissions by 12 percent from baseline levels generate enough revenue to lower the corporate income tax.

A carbon tax might lead me to insulate my home or refrain. A carbon taxs effect on the economy depends on how lawmakers would use revenues generated by the tax. Effects of a Carbon Tax on the Economy and the Environment.

It imposes expensive administration costs. The carbon tax can be really expensive considering that the government. The proponents claim this would be easy to administrate as there are already special taxes in place in the energy sector that can be used as the foundation to the.

One of the advantages of using carbon tax is that it represents a quantifiable source of revenue generation that can be controlled by government along with providing an. It is a powerful monetary disincentive that motivates transition to clean energy across the economy simply by. It is a form of carbon pricing and aims to reduce global carbon emissions in.

One advantage of a carbon tax would be higher emission reductions than from other policies at the same price. The presence of a carbon tax would help to reduce the amount of this greenhouse gas in the. Lower potential quality of products especially smaller.

A carbon tax would reduce the amount of CO2 being released to the atmosphere. A carbon tax is a fee on the carbon content of fossil fuels. If all goes well the offsets will reduce the amount of water in your.

The carbon tax can be regarded as the price for one unit of carbon that is emitted into our atmosphere.

Could Revenue Recycling Make Effective Carbon Taxation Politically Feasible Science Advances

Economics And Policy At The 49th Parallel Economists Are Like Accountants Except Without The Personality

Why Carbon Pricing Is Not Sufficient To Mitigate Climate Change And How Sustainability Transition Policy Can Help Pnas

Reckless Or Righteous Reviewing The Sociotechnical Benefits And Risks Of Climate Change Geoengineering Sciencedirect

27 Main Pros Cons Of Carbon Taxes E C

Carbon Tax Advantages And Disadvantages Economics Help

/cdn.vox-cdn.com/uploads/chorus_asset/file/11706985/rgh_carbon_tax_2018_emissions.png)

Carbon Tax Debate The Top 5 Things Everyone Needs To Know Vox

Carbon Tax What Are The Pros And Cons Climateaction

Australian Carbon Tax Guide With Pros And Cons Green Eatz

Synoptic Revision Micro Macro Effects Of A Carbon Tax Youtube

Climate Change Education Across The Curricula Across The Globelesson Plan Environmental Economics Cap And Trade

27 Main Pros Cons Of Carbon Taxes E C

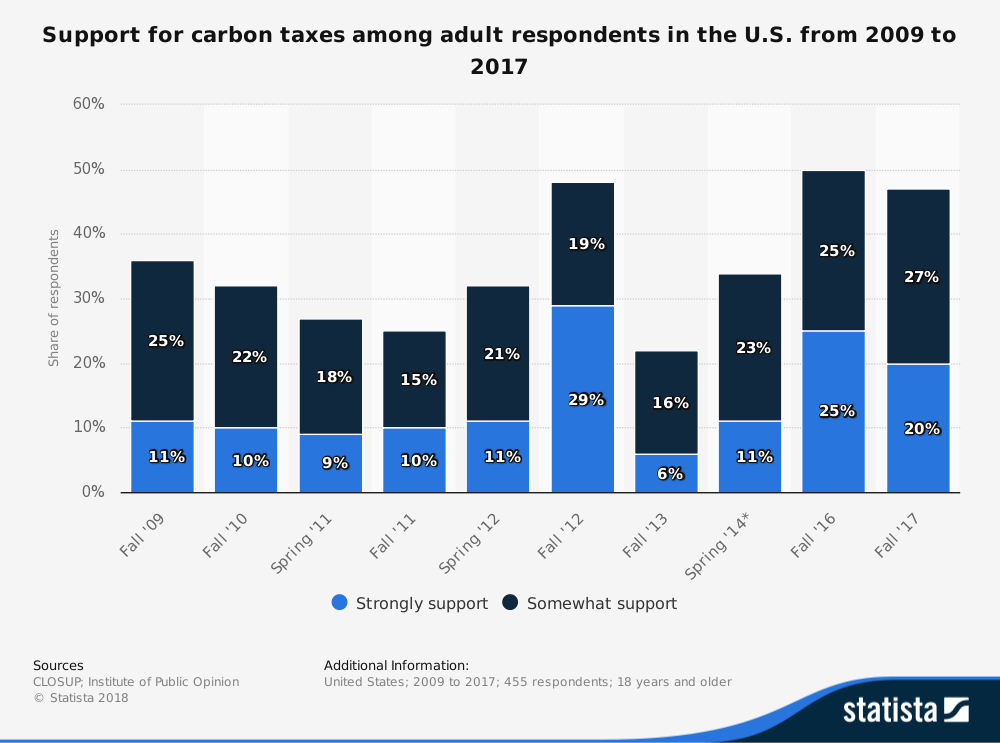

Building Political Support For Carbon Pricing Scholars Strategy Network

The Benefits And Disadvantages Of A New Tax Carbondigital

14 Advantages And Disadvantages Of Carbon Tax Vittana Org

Pragmatism Over Purism How To Design A Carbon Tax To Win Political And Social Support Iiea

The Role Of Carbon Capture And Utilization Carbon Capture And Storage And Biomass To Enable A Net Zero Co2 Emissions Chemical Industry Industrial Engineering Chemistry Research

Could Revenue Recycling Make Effective Carbon Taxation Politically Feasible Science Advances