what is suta tax rate

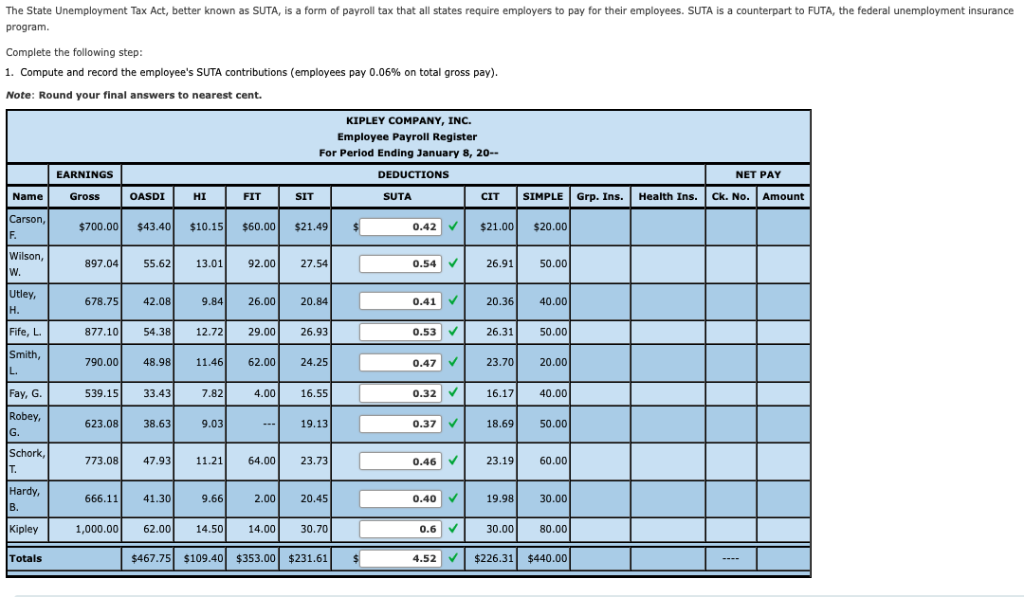

A Contribution Rate Notice Form UC-657 is mailed to employers at the end of each calendar year and shows the contribution rate effective for the coming calendar year. What Are Employer Unemployment Insurance Contribution Tax Rates.

You can decrease this federal rate by up to 54 percent of the rate you pay to your state sometimes referred to.

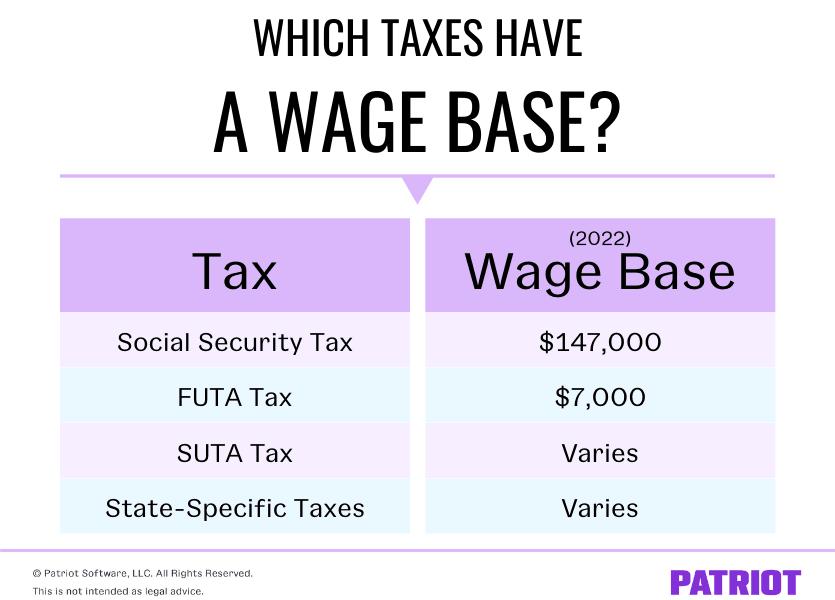

. 52 rows An employers SUTA rate is often referred to as a contribution rate. Your effective tax rate multiplied by your taxable wages determines the amount of tax you pay. FUTA is federally managed and states regulate SUTA.

There is no maximum tax. Review the PIT. State Experience Factor Employers UI Contribution Rates - EA-50 Report for 2017 EA-50 Report for 2018 EA-50 Report for 2019 EA-50 Report for 2020 EA-50 Report 2021.

The Oregon Employment Department mails notifications to. Form W-4 or DE 4 on file with their employer. These rates do not include the Workforce Investment and Training contribution rate that might be applicable for the rate year.

Employers with a zero rate are still required to file quarterly contribution and wage reports. Texas law sets an employers tax rate at their NAICS industry average or 27 percent whichever. To see the tax rate schedule ratio rate table and the FUTA creditable factors for ratio-rated employers select the year.

The time period for filing a protest or appeal from a rate determination or redetermination is 30 days from the date of mailing the same as for all other determinations and redeterminations. Louisiana Unemployment Insurance Tax Rates. For example if you own a non-construction business in California in 2021 the SUTA new employer tax rate is 34 and the taxable wage base per worker is 7000.

Specific industries with higher rates of turnovers might experience an increase in SUTA tax rates. The maximum tax rate allowed by law is 0540 54 except for employers participating in the Short Time Compensation Program. The new employer SUI tax rate remains at 34 for 2021.

This means the effective federal tax rate is 06 percent. Unemployment tax rates for employers subject to Oregon payroll tax will move to tax schedule three for the 2022 calendar year. SUTA rates in each state typically range from 065 to 068.

The 2018 rate is 6 percent. The withholding rate is based on the employees Form W-4 or DE 4. The federal government applies a standard 6.

To calculate your SUTA tax as a new employer multiply your states new employer tax rate by the wage base. As a result of the ratio of the California UI Trust Fund and the total wages paid by all employers continuing to fall below 06 the 2021 SUI tax rates continue to. When the United States Department of Labor certifies that the states unemployment compensation program meets federal requirements employers that pay their state unemployment tax on time and in full receive a 54 percent credit to be applied against their FUTA tax rate.

What is the SUTA tax rate for 2021. SUTA Tax Rates SUTA rates by state as well as the taxable wage base differ from each other. This means that the employer has not paid the tax due on the payroll on or before.

2022 PDF 2021 PDF 2020 PDF. Your tax rate will vary between 00 and 54 due to a number of factors. The tax rates vary from state to state and are updated periodically.

For example if you own a non-construction business in California in 2021 the SUTA new employer tax rate is 34 and the taxable wage base per worker is 7000. Lets say your business is in New York where the lowest SUTA tax rate for 2021 was 2025 and the highest was 9825 and youre assigned a rate of 4025. Your taxable wages are the sum of the wages you pay up to 9000 per employee per year.

The first four tax rate components play a role in ensuring adequate funding of benefit payments and ongoing solvency of the Unemployment Compensation Trust Fund. This contribution rate notice serves to notify employers of their. Unemployment Insurance UI and Employment Training Tax ETT are employer contributions.

You have an employee who makes 45000 a year. Multiply the tax rate by the taxable. Therefore you must pay 238 0034 x 7000 per employee.

If an employer has no paid taxable payroll during the four-year period ending June 30th of the prior year they are assigned the maximum base tax rate of 62. This percentage is applied to taxable wages paid to determine the amount of employer contributions due. The 2022 payroll tax schedule is a modest shift down from the 2021 tax schedule with an average rate of 197 percent on the first 47700 paid to each employee.

The 54 rate can be earned or it can be assigned to employers who have delinquencies greater than one year and to those employers who fail to produce all work records requested for an audit. The 2022 wage base is 7700. There is no taxable wage limit.

Once you know your assigned tax rate youll be able to calculate the amount of SUTA tax youll need to pay for each employee. The contribution rate. To calculate your SUTA tax as a new employer multiply your states new employer tax rate by the wage base.

California has four state payroll taxes. No employer eligible for a modified rate will have a tax rate of less than the general experience ratio for the year. The tax rate is mailed to employer yearly on Form UIA 1771.

This notice is a determination and can be protestedappealed like any other determination. Employer UI tax rate notices are available online for the following rate years. How is the SUTA rate calculated.

2022 Federal State Payroll Tax Rates For Employers

Calculate Employer S Total Futa And Suta Tax As Tclh Chegg Com

Glencoe Mcgraw Hill Payroll Taxes Deposits And Reports Ppt Download

What Is Futa Basics And Examples Of Futa In 2022 Quickbooks

Solved The State Unemployment Tax Act Better Known As Suta Chegg Com

Futa Suta Unemployment Tax Rates Procare Support

Futa Tax Overview How It Works How To Calculate

Suta Vs Futa What You Need To Know

Suta And Futa Calculations Pdf Payroll Tax United States Economic Policy

State Unemployment Tax Act Suta Tax Rates 123paystubs Youtube

What Is Futa An Employer S Guide To Unemployment Tax Bench Accounting

How To Calculate Payroll Taxes Futa Sui And More Surepayroll

What Is A Wage Base Definition Taxes With Wage Bases More

Are Employers Responsible For Paying Unemployment Taxes

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

What Is The Futa Tax 2022 Tax Rates And Info Onpay

How To Calculate Unemployment Tax Futa Dummies

What Is Futa An Employer S Guide To Unemployment Tax Bench Accounting